Coffee Beans Too Expensive?! Coffee Exchange Prepares to Sell 2-Year-Old Coffee Beans!

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style).

For more premium coffee beans, please add FrontStreet Coffee's private WeChat, ID: qjcoffeex.

Brazil's Coffee Production Challenges

Brazil, the world's largest coffee-producing country, has experienced extreme weather conditions including droughts and frosts since last year, resulting in poor coffee bean harvests for the 2022/23 production season. Brazil's Procafe Foundation also stated last month that drought conditions in Brazil's coffee-producing regions this year are worse than during the same period last year.

These extreme weather conditions not only bring uncertainty to Brazil's Arabica coffee bean production for this year and next, but also affect ICE exchange coffee inventories, thereby sustaining the upward trend in coffee futures prices.

The United States Department of Agriculture (USDA) stated in its Brazil coffee annual report published in June that Brazil's total coffee bean production for the 2022/23 season (including Robusta) is expected to be 64.3 million bags (60kg per bag), but the actual situation may be far below expectations.

According to preliminary forecasts from Brazil's National Supply Company (Conab) in May, Brazil's total coffee production for the 2022/23 season is 53.4 million bags (60kg per bag), with Arabica coffee production at approximately 35.7 million bags (60kg per bag). Local coffee farmers also stated that this year's Arabica coffee bean harvest is less than half of that in typical bumper years.

Market Impact and Price Fluctuations

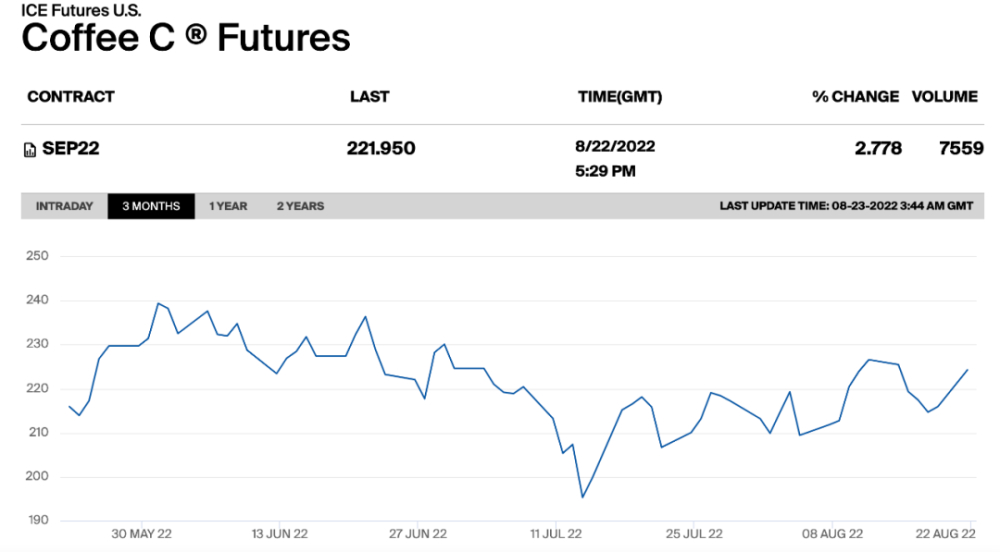

Additionally, the U.S. National Oceanic and Atmospheric Administration predicted in early May that Brazil's southern regions, primarily growing Arabica coffee, would experience three days of frost in late May. This would not only affect already formed/mature fruits but also damage the coffee trees themselves, affecting subsequent flowering and fruiting. Consequently, since mid-May, ICE exchange Arabica coffee futures contract prices surged by 7.47% to 219.2 cents per pound.

However, the eventual frost damage was less severe than expected. Although coffee futures prices retreated later, falling below 200 cents per pound on July 14, and Brazil's domestic coffee spot prices even hit nine-month lows in July, the poor harvest outlook subsequently drove coffee prices higher again.

Inventory Management Solutions

Facing this situation, the U.S. ICE exchange plans to re-evaluate and certify a batch of Brazilian Arabica coffee beans (270,000 bags, 60kg per bag) for external trading to address the current shortage of certified coffee inventories.

According to Reuters, this batch of re-certified Arabica coffee consists of deliveries Brazil made to the ICE exchange between November 2020 and May 2015. However, for various reasons, this batch of coffee beans was ultimately not included in the exchange's certified coffee inventory, even though the exchange's certified coffee inventory was already showing a declining trend at that time.

Starting August 8th this year, ICE's daily reports showed thousands of bags of coffee awaiting grading for inclusion in ICE certified coffee inventories. By August 16th, ICE daily reports showed 263,259 bags (60kg per bag) awaiting grading for inclusion in ICE certified coffee inventories. However, ICE did not specify in its reports whether the pending grading quantity had been previously certified.

Market Concerns and Trading Strategies

Once these aged beans receive certification, they can not only alleviate inventory shortages but also help address the persistently high coffee futures prices. Although this action doesn't violate regulations since ICE only has requirements for certified coffee quality and not for coffee bean harvest years, it has raised questions among many coffee traders about ICE-certified coffee, with concerns about potential mixing of new-season and aged beans in trading.

When traders sell these longer-stored coffee beans, they typically sell directly to roasters, but doing so yields lower profits.

If these coffee beans can obtain ICE recertification and enter warehouses, they can not only supplement the exchange's certified coffee quantity and alleviate high futures prices, but traders can also follow futures prices and sell them with varying discounts based on storage duration, thereby earning more profits than selling directly to roasters.

Market Outlook

However, regarding such actions, some market analysts believe that even if traders take out these coffee beans for market sale, they will eventually be returned to the exchange due to insufficient buyers.

On the other hand, such exchange actions also imply that the quality of coffee beans corresponding to futures prices will decline in the future, causing more traders to have reservations about exchange-certified coffee beans. Trading volume will also decrease, ultimately leading to a decline in coffee futures prices.

Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

What Coffee Varieties Are Produced in Indonesia? Flavor Characteristics of Indonesia's Three Major Coffee Varieties

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style). 1. Mandheling Coffee When discussing Indonesian coffee, we must begin with Mandheling from Sumatra Island. Mandheling [MANDHELING] coffee is the most representative coffee bean variety from Indonesia.

- Next

What is the Best Water Temperature for Pour-Over Coffee? The Impact of Brewing Temperature on Coffee Flavor and Mouthfeel

When it comes to water temperature for pour-over coffee, most people tend to use higher temperatures for extraction, because high temperatures not only improve extraction efficiency but more importantly, can extract rich sweet and sour aromatic flavors. Basically, the water temperature used for pour-over coffee is rarely below 80 degrees Celsius. So, using temperatures below this to brew coffee, is there any...

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee