Luckin Coffee Considers Hong Kong Listing?! Official Response: Continuously Committed to US Stock Market!

On the evening of May 9, South China Morning Post exclusively reported that Luckin Coffee plans to list in Hong Kong.

On May 17, 2019, Luckin Coffee was listed on the NASDAQ in the United States. On January 31, 2020, Muddy Waters Research, a short-seller targeting Chinese concept stocks, released an 89-page report investigating Luckin Coffee's actual store revenue statistics. The report suggested that Luckin acquired a large number of customers through subsidies and engaged in financial fraud to conceal losses. On February 3, 2020, Luckin denied any fraud, stating that Muddy Waters' report was factually groundless and highly misleading.

Before the U.S. stock market opened on April 2, Luckin Coffee announced that an internal investigation revealed that the COO and some of his subordinates had engaged in certain improper behaviors since the second quarter of 2019, with sales related to forged transactions amounting to approximately 2.2 billion yuan. This meant that Luckin ultimately admitted to the allegations in the investigation report. On June 29, 2020, Luckin Coffee was officially delisted from the NASDAQ exchange.

After two years of "reshuffling," "management overhaul," and "self-rescue," on January 27, 2022, Centurium Capital announced that the buyer group it led had completed the acquisition of shares from certain Luckin Coffee shareholders. This meant that in terms of shareholding relationships, Lu Zhengyao and the previous Luckin management had been completely removed.

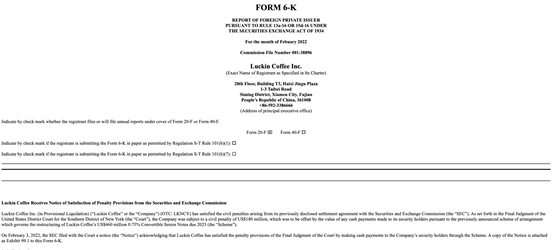

In a document submitted to the U.S. Securities and Exchange Commission (SEC) on February 4, 2022, Luckin Coffee showed that it had met the conditions of the settlement agreement previously reached with the SEC, at a cost of $187.5 million (approximately 1.2 billion RMB in fines), in exchange for the SEC not pursuing further action against Luckin Coffee. This may have marked the end of Luckin's financial fraud scandal.

Some analysts believe this settlement might be paving the way for Luckin Coffee's re-listing. Prior to this, media outlets had reported that Luckin Coffee was studying plans to re-list in the United States, but Luckin subsequently denied this matter.

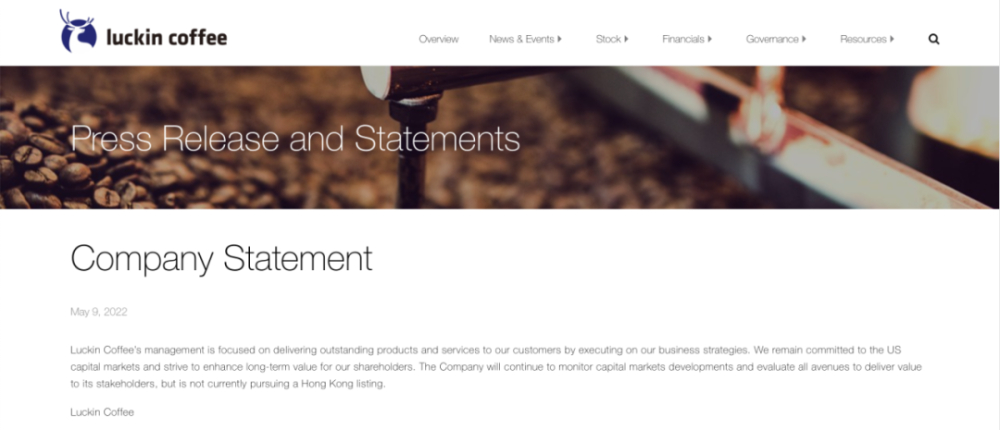

In response to the recent report about plans to list in Hong Kong, Luckin officials also responded: "Luckin Coffee's management is focused on implementing the company's business strategy and providing excellent products and services to customers. The company will continue to commit to the U.S. stock market and strive to enhance long-term value for company shareholders. The company will continue to monitor developments in capital markets and evaluate ways to create value for all stakeholders, but currently has no plans to list in Hong Kong."

Luckin's Remarkable Turnaround

On April 11, 2022, Luckin Coffee announced that it had successfully completed its financial debt restructuring and was no longer subject to bankruptcy or insolvency proceedings in any jurisdiction. Guo Jinyi, Chairman and CEO of Luckin Coffee, stated: "With the support of our creditors, Luckin Coffee concludes its bankruptcy proceedings as a debtor. Today marks a new beginning for Luckin Coffee." According to Luckin Coffee's fourth quarter and full-year 2021 financial performance report previously released on its official website, Luckin Coffee's revenue doubled in 2021, with total net revenue reaching 7.965 billion yuan, a year-on-year increase of 97.5%.

In fiscal year 2021, Luckin Coffee also opened a net of 1,221 new stores, a 25.4% year-on-year increase in store units. As of the end of the fourth quarter of 2021, Luckin Coffee had a total of 6,024 stores, surpassing Starbucks China's 5,557 stores, making it the largest coffee chain brand in all of China.

From setting the record for the fastest domestic company listing to experiencing a plummet due to financial fraud scandals, then rapidly completing debt restructuring and provisional liquidation, and delivering impressive operational results again, this once-critical coffee brand has demonstrated super survivability to capital markets. At that time, industry analysis suggested that Luckin might even return to NASDAQ, becoming a classic business case of a "comeback" under pressure.

Future Prospects and Challenges

From the perspective of investment professionals, Luckin's return to NASDAQ is theoretically not problematic. The possibility of re-listing depends on whether it can regain investor trust. Luckin's re-listing would involve a transfer from the over-the-counter market. If the company's submitted documents are approved by the U.S. Securities and Exchange Commission and deemed to provide adequate investor protection, a return to the main board is permitted according to regulations.

However, during Luckin's "comeback" period over the past two years, domestic coffee brands have quickly completed multiple financing rounds and expanded rapidly, while international coffee brands have also accelerated their entry into the Chinese market. Even if Luckin makes a comeback, it will face fierce competition within the industry. Meanwhile, the difficulty of Luckin Coffee's current U.S. listing has increased because Chinese regulatory authorities have introduced new regulations. For companies not yet listed, there are now many more items and departments that require approval, thus increasing the difficulty of U.S. listings.

Some food industry analysts believe that the Luckin brand as a whole has entered a positive development cycle. Although the financial fraud scandal brought significant criticism to the Luckin brand, current operational performance is very impressive. Therefore, a return to capital markets is expected soon, and the company's cash flow situation will gradually improve, achieving healthy and orderly development.

Image source: Internet, Luckin official website

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style)

For more specialty coffee beans, please add the private WeChat of FrontStreet Coffee (FrontStreet Coffee), WeChat ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Pros and Cons of Center Pouring Method in Pour-Over Coffee: Analysis of Water Distribution and Circular Movements

FrontStreet Coffee mentioned in the article "The Science of Water Pouring" that circular pouring has clear advantages over center pouring. Especially in terms of stability and uniform extraction, the center pouring method falls short. This time, let's switch to the perspective of the center pouring method. If this method truly has no merits, then...

- Next

A Popular Coffee Shop Fined 25,000 Yuan for Using Coffee Beans from Unverified Sources

Recently, market regulators in Yuecheng District, Shaoxing City, have lawfully investigated and penalized a popular coffee shop for selling products made with imported coffee beans from unverified sources. According to the Shaoxing Evening News report, when market regulators in Yuecheng District conducted an inspection based on leads, they discovered that the coffee shop was using "ETHI...

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee