Luckin Coffee Pays 1.2 Billion Fine! Lu Zhengyao Affects Investor Financing for Luckin

Luckin Coffee's $187.5 Million Settlement May Mark End to Financial Scandal

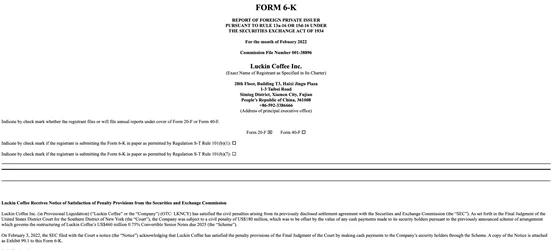

On February 4, documents submitted by Luckin Coffee to the U.S. Securities and Exchange Commission (SEC) showed that Luckin Coffee has met the conditions of a previously reached settlement agreement with the SEC, at a cost of paying a $187.5 million (approximately 1.2 billion RMB) fine to secure the SEC's abandonment of further pursuit of Luckin Coffee's liability. This may mark an end to Luckin's financial fraud scandal.

$187.5 million represents a legal settlement reached between Luckin Coffee and the SEC through legal procedures established under American law, reflecting a characteristic of the American judicial system. This indicates that Luckin Coffee has admitted partial charges while avoiding a lengthy judicial process and the costs associated with SEC prosecution. However, this penalty is by no means a small amount. Based on the average price of 15-16 RMB per coffee beverage on the Luckin app at the time (before price increases), approximately 75 million cups of coffee would need to be sold to recoup this amount, not yet deducting costs.

Excluding costs, Luckin frequently distributed 62% discount coupons at the time, meaning a cup of coffee cost 5-6 RMB, requiring the sale of approximately 200 million cups of latte coffee... If truly calculating "earning back" this settlement, various costs would also need to be deducted, which would require washing how many cups... Of course, Luckin certainly wouldn't rely solely on selling coffee to recover this settlement money.

Settlement as Foundation for Relisting

This settlement between Luckin Coffee and the SEC may be laying the groundwork for Luckin Coffee's relisting. Although reports previously emerged that Luckin Coffee was studying plans to relist in the United States, these were subsequently denied by Luckin's management.

In fact, if Luckin Coffee had not settled with the SEC, besides being unable to trade in the stock market, the SEC would still have continued to prosecute Luckin. The settlement provides both parties with an opportunity to quickly conclude the investigation. On one hand, it serves to "save face" and maintain credibility in capital markets; on the other hand, Luckin Coffee's continued development will require significant market financing for business expansion, forcing Luckin to continue valuing the investment value of American investors and ending the game according to rules.

Rise and Fall of Luckin Coffee

Lu Zhengyao first completed his first company's listing through CAR Inc., applying this listing experience and network in financial circles to create another Luckin myth. Qian Zhiya, Executive Vice President of CAR Inc., independently founded Luckin Coffee, which went public in just a few years from its establishment. While it appeared to have connections with CAR Inc. and Lu Zhengyao, it was precisely the capital relationship that provided Luckin Coffee with the capital for crazy subsidies and insane expansion, making it a capital myth for a time.

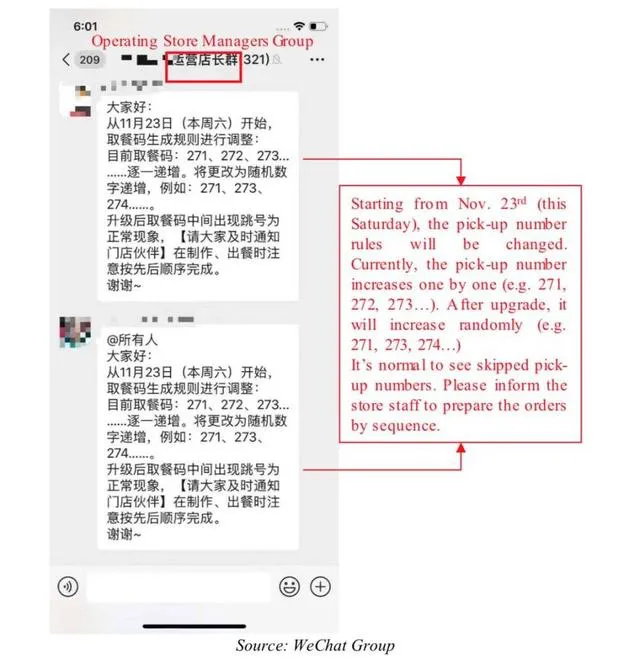

However, this prosperity was short-lived. On January 31, 2020, Muddy Waters Research, a short-selling agency targeting Chinese concept stocks, released an 89-page report investigating the actual business revenue statistics of Luckin Coffee stores. The report concluded that Luckin acquired a large number of customers through subsidies and engaged in financial fraud to conceal financial losses. Muddy Waters deployed 92 full-time and 1,200 part-time staff to collect 25,000 shopping receipts, concluding that Luckin's order volume, average customer spending, and advertising expenditures were seriously inflated, deceiving numerous investors. In other words, most investors' money became Luckin's cheap coffee.

On February 3, 2020, Luckin denied the existence of fraud, stating that Muddy Waters' report had no factual basis and was extremely misleading. On April 2, before the U.S. stock market opened, Luckin Coffee announced that an internal investigation revealed that the COO and some subordinate employees had engaged in certain misconduct since the second quarter of 2019, with sales related to forged transactions amounting to approximately 2.2 billion RMB. This meant that Luckin ultimately admitted to the allegations in the investigation report. On June 29, 2020, Luckin Coffee was officially delisted from the Nasdaq exchange.

New Beginning for Luckin in 2022

After the exposure of Luckin's financial fraud, judging from the statements of all parties involved, management adjustments, and capital changes, all attention was focused on Lu Zhengyao, indicating that Lu Zhengyao was the ultimate controller behind this incident. Muddy Waters' report also confirmed that this was a business model that could not withstand scrutiny.

2022 will be a year of new beginnings for Luckin. On January 27, Centurium Capital announced that the buyer group it led completed the acquisition of equity from certain shareholders of Luckin Coffee. This means that from an equity relationship perspective, Lu Zhengyao and the early Luckin management have been completely eliminated.

Additional Information

Image source: Internet

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style)

For more premium coffee beans, please add the private WeChat of FrontStreet Coffee, WeChat ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

What Does Coffee Layer Complexity Mean? Pour-Over Parameter Methods to Enhance Layer Complexity: Water Temperature and Grind Size Adjustments

Some coffee enthusiasts have told FrontStreet Coffee that their brew produces a very clear and delicious front-end, but the aftertaste lacks strength. The middle to back-end loses that amazing quality, becoming rather empty. When they tried the same coffee beans at FrontStreet Coffee's store, they experienced a rich, complex, and full-bodied profile. Since FrontStreet Coffee initially did not

- Next

Guide to Judging Yellow Point and First Crack in Coffee Bean Roasting: What Causes Underdeveloped and Astringent Flavors in Coffee?

As the title suggests, this article by FrontStreet Coffee is primarily aimed at providing mental preparation for those about to enter the world of coffee roasting. In the first five lessons of "Coffee Roasting from Zero," only very basic roasting theories were explained. The simplicity level is roughly equivalent to the "multiplication table" in mathematics. We must recognize a reality that theory...

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee