Brazilian Coffee Instability Pushes Arabica Futures to Highest Level Since 2017

Professional Coffee Knowledge Exchange. For more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style).

Arabica Coffee Prices Reach Five-Year High

According to a recent report from the ICO, Arabica coffee prices rose for the fifth consecutive month in March, marking the longest upward trend in five years. March Arabica prices increased by 0.8% compared to February, reaching the highest level since September 2017. Currently, Arabica prices are up 13.7% compared to the same period last year.

The ICO report emphasized that weather factors in producing regions have led to tight Arabica supply, which has supported Arabica coffee prices reaching their highest level in over three years. Due to various instabilities caused by COVID-19 and last year's drought in Brazil, uncertain forecast data frequently provided by the market has supported coffee prices while also exacerbating the volatility of the upward price trend.

As the ICO report was published, some countries expressed concerns about potential shortages of coffee harvesting workers due to COVID-19 isolation measures. Sucden Financial expressed the Colombian government's concerns about "coffee harvesting worker shortages," while also pointing out that Central America may experience coffee crop failures and unharvested crops in recent months due to last year's dual hurricanes and labor shortages.

Colombian Coffee Production Shows Strong Growth

However, according to recent data released by the Colombian National Federation of Coffee Growers (FNC), Colombia's coffee production in March totaled 1.05 million bags, a 30% increase from 806,000 bags in March 2020. In the first three months of 2021, Colombia's coffee production totaled 3.238 million bags, a 13% increase from 2.857 million bags in the same period last year. To date, Colombia's coffee production in the 2020/21 season (October 2020 to March 2021) totaled 7.583 million bags, a 2% increase from 7.412 million bags in the same period last year.

ICO data shows that Colombian Arabica coffee bean prices rose 0.3% to 177.49 US cents per pound in March, the highest level in six years. Meanwhile, Arabica coffee bean prices from other small producing regions in Central America rose 0.4% to 167.05 US cents per pound, the highest level since 2017.

Brazilian Coffee Market Challenges

Regarding Brazil, Marex Spectron raised its global Arabica coffee bean shortage forecast from 8 million to 10.7 million bags, due to declining production forecasts for Brazilian Arabica coffee beans. Brazilian Arabica coffee bean prices rose 1.7% to 122.16 US cents per pound last month, reaching a 15-month high.

The ICO stated that Brazilian exporters are currently taking advantage of this period of rising prices to continuously export coffee. Brazil exported 20.5 million bags of coffee from October 2020 to March 2021, a 24% increase year-on-year. However, starting from February this year, Brazil's coffee export growth slowed to 9.0%, as the market believes that with large amounts of coffee from the 2020/21 season already exported, Brazilian coffee supply is beginning to become difficult.

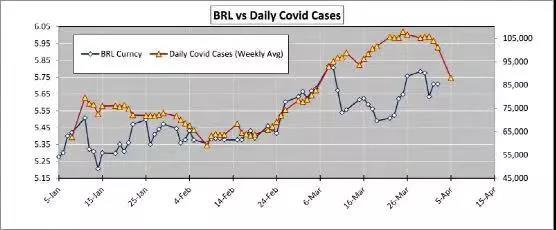

(Brazil's new confirmed cases and coffee price trends)

Currently, the COVID-19 situation in Brazil is extremely unstable! On April 5th local time, 4,196 new cases were added in a single day, once again breaking Brazil's single-day COVID-19 confirmed record. The local government immediately implemented further epidemic prevention measures, including stopping port transportation, which has hindered Brazilian coffee exports. Research institution Cepea predicts that remaining coffee from the 2020/21 season will be exported together with new 2021/22 season coffee beans in May.

For more specialty coffee beans, please add the private WeChat of FrontStreet Coffee, WeChat ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Wet-Hulled Mandheling Coffee Bean Flavor Profile and Processing Method Differences

Introduction Tasting Mandheling coffee reveals a captivating herbal aroma that leaves a lasting impression. How does this distinctive flavor profile connect to Indonesia's unique coffee processing method known as wet-hulling? What makes the wet-hulled process so special? As its name suggests, wet-hulling refers to removing the parchment layer from coffee beans while they still retain

- Next

Flavor Profile and Characteristics of Colombia Purple Caturra Coffee - Passion Fruit Anaerobic Washed Coffee Beans Introduction

Coffee Information Origin: Colombia, Huila Region Estate: Mont Blanc Estate Elevation: 1900 meters Variety: Purple Caturra Processing Method: Passion Fruit Yeast Anaerobic Washed Processing Grade: Supremo Harvest Season: 2021 Region Introduction Colombia's Huila region is located at the intersection of the central and eastern mountain ranges of the Andes, situated in southern Colombia. The coffee growing areas of Huila are known for Pital

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee