Brazilian Coffee Production Region News - Brazilian Coffee Company Allegedly Evaded Taxes and Profited

Professional Coffee Knowledge Exchange

For more coffee bean information, please follow the Coffee Workshop (WeChat public account: cafe_style)

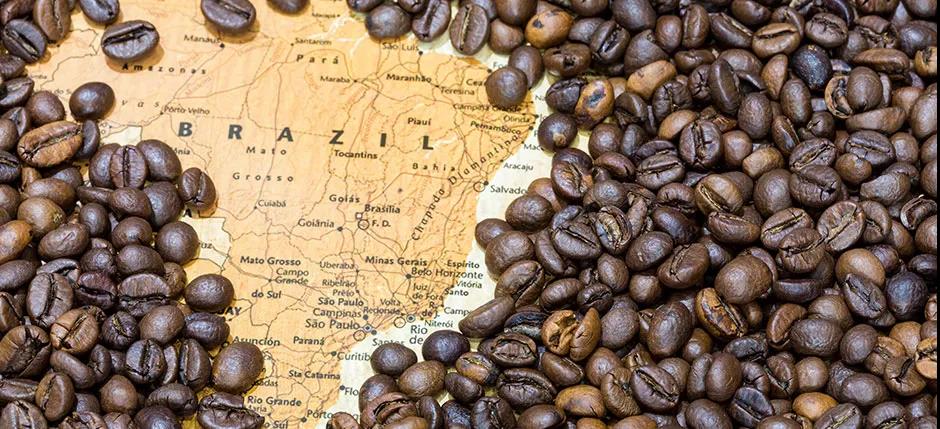

Brazilian Authorities Crack Down on Coffee Tax Evasion Scheme

According to Reuters in São Paulo, prosecutors in Minas Gerais state announced on Tuesday (March 16) that Brazilian authorities have launched surprise raids on coffee trading companies suspected of tax evasion, issuing multiple arrest warrants to combat these companies' tax avoidance practices.

The Minas Gerais Prosecutor's Office stated in a declaration that coffee cooperatives, wholesalers, distributors, and roasters from Minas Gerais, São Paulo, Bahia, and Espírito Santo states were involved in this fraud scheme. Their tax evasion operation amounted to 1 billion reais (equivalent to $178.75 million).

These four states account for over 90% of Brazil's total coffee production. Minas Gerais is Brazil's largest coffee-producing region, mainly producing high-quality Brazilian Arabica coffee beans, while Espírito Santo is the main producer of the Robusta variety, which is widely used in the instant coffee industry.

Officer Tiago Vicentini de Oliveira, who coordinates the special task force investigating this scheme, stated at a press conference on Tuesday (March 16): "Roasters in Bahia state used shell companies established in São Paulo state to purchase coffee beans in Minas Gerais and Espírito Santo states, thereby avoiding payment of certain state taxes and profiting from the price differences."

Brazil's tax system is extremely complex, particularly because the rates of the Brazilian Circulation Tax (ICMS) vary by state, with each state having its own ICMS regulations. This complex system has enabled many companies to exploit loopholes for tax evasion and profit from it.

Brazilian authorities did not disclose the names of the companies under investigation in this announcement. Court prosecutors stated that authorities are executing 35 arrest warrants related to this investigation, and assets of suspects involved in this fraud scheme will be frozen.

For more specialty coffee beans, please add FrontStreet Coffee on private WeChat, WeChat ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Tanzanian Coffee Bean Brewing Methods Introduction Kilimanjaro Coffee Flavor Description

African coffee is undoubtedly dominated by Ethiopia and Kenya. These two major African coffee-producing countries guarantee excellent quality and quantity. Meanwhile, coffee from Tanzania, a major East African nation, has gradually entered people's attention. Tanzanian Coffee Tanzania borders Kenya and began coffee cultivation around the same time. In 1898, Catholic

- Next

How to Froth Milk for Latte Art? What Details to Pay Attention to When Frothing Milk? Latte Coffee Foam Tutorial

Previously, FrontStreet Coffee shared an article on milk frothing tutorial, but some friends still have questions! As the saying goes, details determine success or failure. This barista training article will cover the details to pay attention to during the milk frothing process! Detail 1: Chilled Milk FrontStreet Coffee uses pasteurized fresh milk, which requires low-temperature storage. If you are using room temperature stored

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee