Snow Lake Capital, Alleged Mastermind Behind Luckin Coffee Fraud, Increases Investment in Luckin Shares

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style).

For more premium coffee beans, please add FrontStreet Coffee on private WeChat, ID: qjcoffeex.

Luckin Coffee's Remarkable Turnaround

On the evening of November 7th, Ma Ziming, founder of Snow Lake Capital, stated on a financial website platform: "Luckin Coffee's phoenix-like rebirth is a miracle in Chinese business history!" The post included a presentation file and an 81-page long bullish report, emphasizing his bullish stance.

In an interview with The Wall Street Journal, Ma Ziming said he never thought Luckin Coffee could "rise from the ashes," and that many nearly impossible things have happened. Over the past two years, Luckin Coffee has reformed its business and corporate governance. It's only a matter of time before Luckin Coffee surpasses Starbucks.

The Snow Lake Capital Connection

In early 2020, when Luckin Coffee, founded and taken public by Lu Zhengyao, was exposed for financial fraud and delisted, Snow Lake Capital was speculated by markets and media to be the behind-the-scenes manipulator of the short-selling report that exposed Luckin Coffee's financial fraud.

Regarding the various data in an anonymous report about Luckin Coffee's alleged financial fraud publicly released by the well-known American short-selling institution Muddy Waters Research, many media reports and market rumors at the time pointed to Snow Lake Capital as the source of this anonymous report.

This was because when Luckin Coffee first went public, Snow Lake Capital first commissioned a consulting firm to find professionals to discuss Luckin Coffee's business model, intending to identify existing problems. However, Ma Ziming did not comment on whether he participated in this report or any business investigation related to Luckin.

Corporate Restructuring and Recovery

After the incident, Luckin's investor Centurium Capital joined forces with the new management team to expel the original management core led by Lu Zhengyao, completely restructured Luckin Coffee, and Luckin Coffee's performance grew rapidly. According to Luckin Coffee's financial reports, revenue in 2021 achieved nearly 100% year-on-year growth, reaching 7.965 billion yuan. In the first half of 2022, Luckin Coffee achieved revenue of 5.7 billion yuan, a year-on-year increase of approximately 80%.

Snow Lake Capital began conducting online consumer surveys involving over 100,000 Luckin customers at the beginning of this year. During the report writing period, Ma Ziming stated that they had not communicated with Luckin. He believes that based on Luckin's current growth situation, Luckin's net profit will reach 2.8 billion RMB in 2024, at which time the market profit margin will be 35 times, equivalent to Snow Lake's valuation of Starbucks' China business.

New Management Strategy

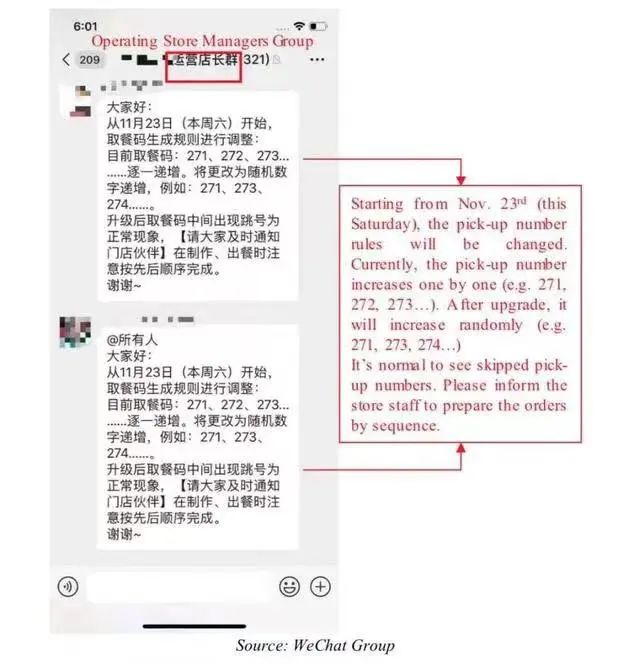

Centurium Capital completely eliminated Lu Zhengyao's influence at Luckin, and the restructured new management team focused on business fundamentals and profitability. The new management team does not pursue store expansion and "new retail" models, but instead focuses on business fundamentals and profitability.

In this regard, Ma Ziming mentioned in an interview with The Wall Street Journal that Snow Lake Capital has bought a minority stake in Luckin Coffee, currently accounting for about 15% of Snow Lake's managed assets (but no specific data), and is betting that its valuation will soar significantly. As long as Luckin can maintain growth, they plan to hold the company's stock for "several years." In addition to Luckin's growth prospects, he is also very optimistic about the possibility of its relisting in the United States.

Market Advantages and Consumer Appeal

Ma Ziming is so optimistic about Luckin Coffee partly because the impact of the pandemic has changed consumers' coffee consumption habits. More and more consumers choose takeout/packaging, gradually reducing the demand for coffee shop space. Coffee shops like Starbucks that provide third-space types have also been affected. However, Luckin Coffee, which has always focused on pick-up stores, has instead won more opportunities.

Another point is that Luckin Coffee deeply understands the needs of consumers in the Chinese local market and continuously launches beverage-style coffee as well as new products. Beverage-style coffee and franchise models are helping Luckin penetrate lower-tier markets more efficiently, with fast product launches and affordable prices, which is exactly what mass consumers demand.

Conclusion

It must be said that Luckin's performance over the past two years has indeed been outstanding. Not only has it regained investor confidence through actions, but it has also accurately grasped the product demands of local consumers.

Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Can Coffee Beans Be Re-Grinded If the Grind Isn't Fine Enough? The Principles and Effects of Double Grinding Coffee Beans

Some friends shared an interesting approach with FrontStreet Coffee: "Sometimes I forget to adjust the grind setting, and the coffee grounds turn out too coarse, but I don't want to waste them, so I adjust the grinder to the appropriate setting and grind the coffee beans again." FrontStreet Coffee replied with a smile: "Which new grinder have you been eyeing recently?" This

- Next

Coffee Night Markets Becoming a Trend! Late Night is When Coffee Shops Do Their Best Business!

For more professional coffee knowledge and coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more premium coffee beans, please add FrontStreet Coffee on WeChat: qjcoffeex In most people's impression, don't you feel that coffee is mostly consumed during the day, and should not be consumed before bed

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee