64% Loss! Behind Tims China's NASDAQ Listing Lies Massive Capital Deficit

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style)

For more specialty coffee beans, please add private WeChat: FrontStreet Coffee, WeChat ID: qjcoffeex

Tims China's Nasdaq Debut: A Challenging Start

Today marks one month since Tims China's listing on Nasdaq. However, up to now, the performance of this coffee company attempting to become the second Starbucks in the US stock market seems to still be disappointing.

On September 29, 2022, Tim Hortons China business (abbreviated as Tims China) was listed on the US Nasdaq stock exchange under the ticker symbol "THCH". This is the second Chinese coffee company to be listed on Nasdaq after Luckin Coffee. Tims China broke immediately upon listing, with the closing price on the first day at $7.29, already down 8.76%. The first day already showed a downward trend, and the performance after listing has been rocky.

According to Sina Finance reports, on October 28, Tims China (THCH) was priced at $3.55, representing a discount of approximately 64% compared to the $10 SPAC shell company at the time of listing. This magnitude of decline is likely disappointing not only to ordinary market investors but also to the capital behind Tims China - Cartesian Capital Group.

Background and Market Position

Tim Hortons was founded in Canada in 1964. In 2018, Tim Hortons' parent company RBI and Cartesian Capital jointly established Tims China, with Cartesian Capital Group as the largest shareholder. In 2019, Tim Hortons officially entered China, opening its first store in People's Square, Shanghai. Yes, just when Luckin Coffee and Starbucks China were engaged in fierce competition, Tims China had just obtained its entry ticket.

Tims doesn't offer 62% discount coupons. Relying solely on small red cups printed with maple leaves paired with cheese-covered bagels, it has still attracted a large wave of young people. Some consumers believe that Tims is more of a bakery than a coffee shop, as the texture of its bagels far exceeds that of its coffee. On Xiaohongshu, some netizens even commented: "My breakfast is from them every day. I usually go to Tims to buy bagels and go to Manner to buy coffee."

Financial Performance Analysis

According to online data, from 2019 to 2021, Tims China's revenues were 57.257 million yuan, 210 million yuan, and 640 million yuan respectively, mainly derived from product sales at self-operated stores, franchise fees, other franchise businesses, and e-commerce businesses. In 2021, the revenue proportions of these four businesses were 95.9%, 0.3%, 1.5%, and 2.2% respectively.

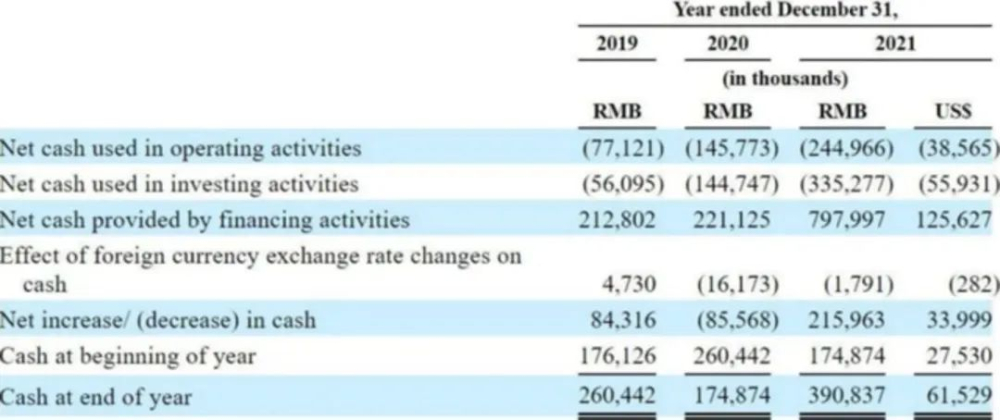

From the above data, it can be seen that 2021 was the fastest-growing year for Tims China, with its revenue surging by 203%, more than three times that of 2020. However, net losses also multiplied. From 2019 to 2021, Tims China's net losses were 87.828 million yuan, 140 million yuan, and 380 million yuan respectively. The net loss in 2021 expanded more than two times compared to 2020, with a total loss of over 600 million yuan in three years.

Strategic Challenges and Future Outlook

This situation bears striking resemblance to a certain new-style tea brand - the more stores opened, the greater the losses. Regarding the issue of severe losses, Tims China explained that this was due to rising raw material prices and the impact of the pandemic. Indeed, after Tims China was established, it coincided with the continuous rise in global coffee bean prices, and this year, due to weather, pandemic, and other factors, prices have risen particularly sharply.

Despite continuous losses, Tims China is still "burning money" for scale. According to the plan of Lu Yongchen, head of Tims China's marketing department, they will continue to expand into second and third-tier cities. It is expected that by 2026, the number of Tims stores will increase to 2,750, which may lead to more efficient strategic deployments.

However, at present, Tims, with 500 stores, is still far from having a scale advantage. The listing is just the beginning. For Tims, which has experienced frequent stock market declines since its listing, there is no need to be overly pessimistic. After all, in this booming Chinese coffee market, it remains to be seen who will last until the end.

Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Why Do Baristas Love Tattoos? Coffee Tattoo Design Recommendations

For more professional coffee knowledge and coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more premium coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. Recently, a scene occurred in a coffee shop that made many baristas' hearts ache: a customer...

- Next

Coffee Shop Bar Design Recommendations: Essential Tips for Coffee Bar Counter Renovation

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (official WeChat account: cafe_style). For more specialty coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. The soul of any coffee shop lies in the bar counter design. The bar serves as the space where guests form their first impressions of your establishment.

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee