Nayuki Loses 250 Million in Six Months, Now Invests in Coffee Brands for Self-Rescue...

The booming new-style tea beverage industry has fattened up numerous suppliers, while leaving tea brands to fiercely compete on their own. Nayuki, known as the "first new-style tea stock," was highly anticipated before its listing due to being the first among peers to successfully go public. However, since going public, Nayuki has not thrived as imagined, with its glaring revenue and loss figures causing industry professionals to rethink.

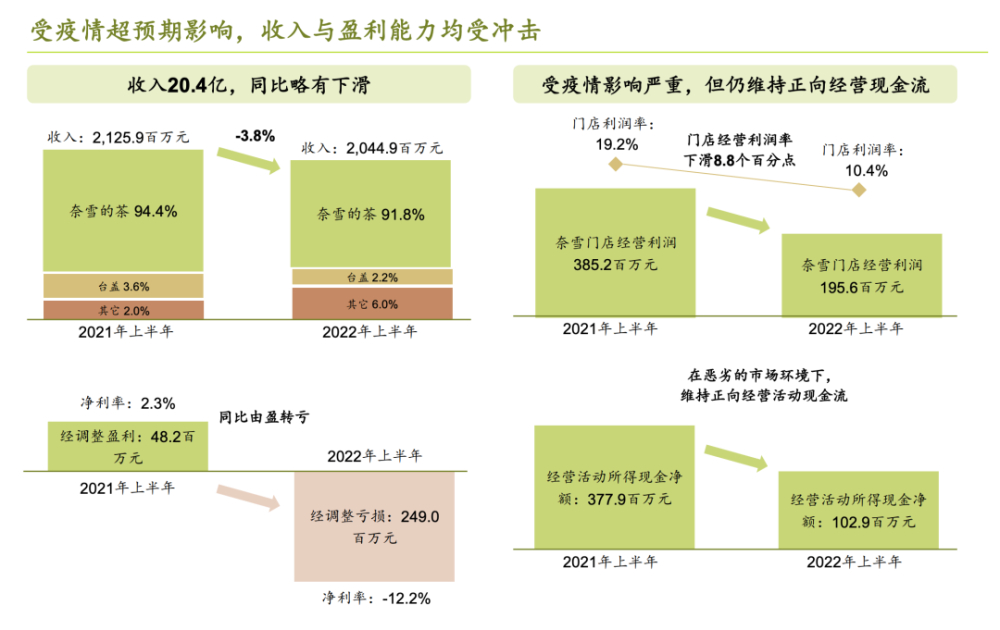

Nayuki's recently released financial report for the first half of 2022 shows revenue of 2.045 billion yuan, a 3.8% decrease year-on-year, and an adjusted net loss of 249 million yuan, compared to a profit of 48.2 million yuan in the same period last year.

Originally positioned as a high-end brand, Nayuki joined the "price reduction wave" in the new tea beverage industry at the beginning of this year, focusing on the mid-price segment by reducing prices and launching low-priced new products. The decrease in average customer spending has brought some impact to consumers, but it's worth mentioning that Nayuki's price reduction activities were met with consumer skepticism about being "insincere." According to media reports, many consumers reflected that although Nayuki's single-cup prices have been lowered, the beverage volume they received has shrunk, and the quality is not as good as before.

Furthermore, most of Nayuki's stores are concentrated in first and second-tier cities. Under recurring pandemic conditions, the likelihood of consumers dining in-store has decreased, and declining order volumes have put additional pressure on the company.

The once-popular online tea beverages, no longer being "hot commodities," have had to begin their paths to self-redemption, with each taking different approaches.

Heytea tends to cast a wide net in the beverage industry. Currently, brands invested in by Heytea include coffee brands Seesaw and Minority, plant-based milk brand Wild Plant YePlant, tea beverage brand Heqitaotaotao, pre-mixed cocktail brand WAT Cocktail, and juice brand Yecuanshan.

Expansion and Diversification Strategies

Cha Yan Yue Se, once "unable to expand beyond" Changsha, has now accelerated its expansion pace for corporate salvation. According to Tianyancha, since 2022, Cha Yan Yue Se has established 7 new companies mainly involved in supply chain management, restaurant management, and beverages, covering regions including Nanjing, Wuhan, Changsha, and Chongqing. Additionally, Cha Yan Yue Se has ventured into the coffee sector with the launch of "Yuanyang Coffee," opening five stores simultaneously in Changsha's "May 1 Business District" on August 10.

Nayuki, on the other hand, is more persistent in opening cross-border stores, continuously pursuing benchmarking against Starbucks and focusing on the "third space." Examples include the cocktail bar-themed "Nayuki Bla Bla Bar," the bookstore-themed Nayuki Tsinghua University South Gate store, and the experiential tea drink store "Nayuki Dream Factory." However, "Nayuki Dream Factory" closed in May this year for renovation and upgrading, later reopening as "Nayuki Life" experiential store on August 31.

Investment Moves and Market Dynamics

Notably, Nayuki established an investment company at the end of March, entering the venture capital circle. In mid-June this year, in a project submitted by its supplier Tianye Co., Ltd. to the Beijing Stock Exchange, Nayuki invested in its own supplier. Recently, Shanghai Aodimei Food Co., Ltd., associated with coffee brand AOKKA, underwent multiple business changes, with the addition of Shenzhen Pindao Catering Management Co., Ltd., affiliated with Nayuki, as a shareholder with a 21.41454% stake, increasing the company's registered capital from 2 million yuan to 2.545 million yuan.

Since this year, new tea beverage brands have frequently invested in coffee brands. It is understood that in 2021, China's coffee market has already reached 381.5 billion yuan. As China's coffee market enters a period of rapid development, it is expected that by 2025, the market size of China's coffee industry will exceed 1 trillion yuan.

Can Nayuki, living under the halo of the "first new-style tea stock," successfully save itself?

Image source: Network

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style)

For more specialty coffee beans, please add private WeChat FrontStreet Coffee (FrontStreet Coffee), WeChat ID: qjcoffeex

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Why Are Moka Pots So Popular? Can You Add Fresh Milk to Coffee Made with a Moka Pot?

Recently, many friends have been asking FrontStreet Coffee, "What coffee beans are suitable for Moka pots?" So FrontStreet Coffee checked the online sales of Moka pots and compiled some data. The top 4 Moka pots combined have monthly sales of over 2,000, which is quite high for coffee equipment costing several hundred yuan. Moka pots date back to 1933.

- Next

Coffee Golden Cup Extraction Theory: How to Calculate Pour-Over Coffee Extraction Rate and Concentration - Pour-Over Coffee Powder-to-Water Ratio Recommendations

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style). For more specialty coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. Recently, the editor mentioned a case in a barista's complaint article: "I need one..."

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee