Trends in China's Coffee Consumption Market: Are Emerging Coffee Brands on the Rise or Decline?

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style)

The Rise of Coffee Culture in China

In recent years, coffee culture has been gradually permeating China, with coffee enthusiasts and aficionados growing in number, while emerging coffee brands have been springing up like mushrooms after rain.

From the perspective of the entire coffee industry, the growth trend of coffee shops is actually on an upward trajectory.

Market Potential and Consumption Patterns

China's domestic coffee consumption market still holds significant potential. Per capita coffee consumption remains at a relatively low level compared to developed countries. In 2018, mainland China's per capita coffee consumption was only 0.71% of Germany's and 1.6% of America's. The global coffee market size exceeds 12 trillion yuan, while China currently accounts for only about 700 billion yuan, showing a significant disparity relative to its population. Income growth promotes coffee consumption, with every 5% increase in national income leading to a 2%-3% increase in daily coffee consumption. As national income rises and consumer coffee habits gradually develop, the potential market space for coffee is enormous.

As "emerging coffee brands," this has become a relatively new topic in recent years. Last year, various industries were affected by the COVID-19 pandemic, with many coffee shops suffering heavy blows. Numerous coffee shop owners faced operational crises and ultimately had to close their businesses.

According to data from Coffee Salon's "2021 Coffee Census" regarding "coffee shop opening times," the proportion of newly opened coffee shops within six months increased from 16.43% last year to 16.80%. The proportion of coffee shops opened within the past year was 32.26% in 2019 and 30.26% in 2020. This data suggests that the opening rate of coffee shops in 2020 was not significantly affected by the pandemic.

Additionally, according to a "White Paper on China's Fresh Ground Coffee Industry" (hereinafter referred to as "White Paper") report released by Deloitte China and Mumian Capital, the number of coffee shops in China had exceeded 100,000 by the end of 2020.

Consumption Patterns and Market Evolution

If we look at coffee consumption by product type, related data shows that instant coffee accounts for 72%, ready-to-drink coffee 10%, and fresh ground coffee 18%. This data indicates that instant coffee occupies a crucial position in the overall coffee category. Coupled with the impact of last year's pandemic, the coffee category underwent a major reshuffle. The pandemic promoted home coffee consumption and instant coffee, making the coffee category more diverse. For example, more hang-drip coffee, cold brew coffee, and creative coffee have appeared on the market. Undoubtedly, coffee has become one of the fastest-growing beverage categories in recent years. On this basis, coffee market consumption demand has been further met. Of course, as times progress, coffee is also improving. Domestic emerging coffee brands (such as Yongpu, Sandunban, etc.) have also been working to restore the reputation of instant coffee through quality raw materials and technology in recent years.

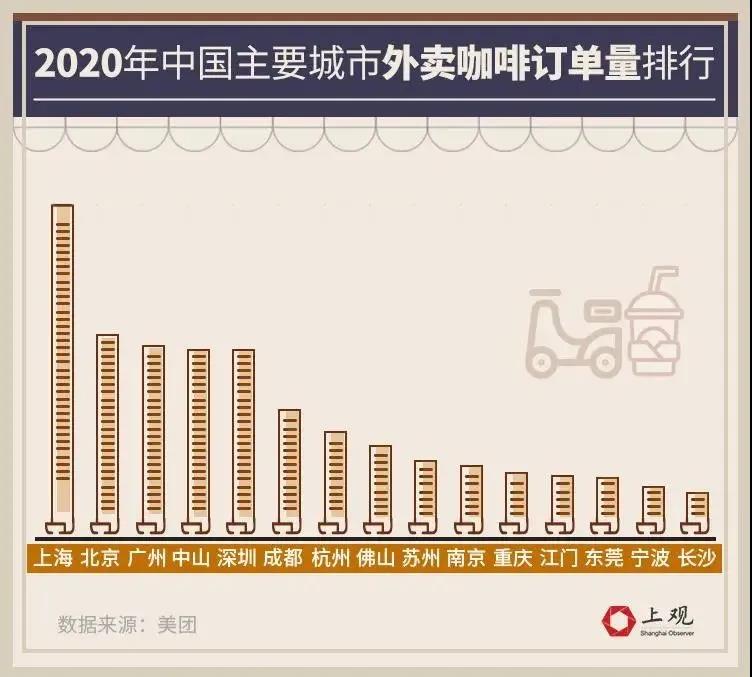

During the 2020 pandemic, global coffee consumption also showed an upward trend, mainly depending on online e-commerce businesses. On one hand, coffee shops providing delivery services increased from 68.26% in 2019 to 74.25% in 2020. According to recent White Paper report information, from the perspective of competition patterns in first-tier and new first-tier cities, high-value coffee brands focusing on "fast coffee" scenarios and specialty coffee brands focusing on "slow coffee" scenarios are gradually gaining market share. Additionally, according to Shangguan data, Shanghai ranked highest among major Chinese cities in terms of delivery coffee order volume in 2020.

Image source: Shangguan data

On the other hand, Tmall's emerging coffee brand order volume growth rate reached 300%, showing explosive growth in online consumption models.

Future Outlook and Investment

With the continuous impact and popularization of coffee culture, the distance between coffee and ordinary consumers is getting closer. Currently, China's coffee consumption market has reached about 100 billion yuan. According to a 2020 Dongxing Securities report, China's coffee consumption growth rate reached 15%, far higher than the global average of 2%. It is expected to reach 1 trillion yuan by 2025. The coffee market holds unlimited potential, and China will become the world's largest coffee consumption market.

Furthermore, the huge potential of China's coffee market has attracted significant capital investment.

Take Canada's national coffee brand Tim Hortons as an example. Last May, Tim Hortons China announced receiving investment from Tencent in the tens of millions of yuan range. Since being exclusively invested by Tencent, Tim Hortons has developed rapidly in the Chinese coffee market, calling it a "huge development opportunity." Additionally, on February 26 this year, Tim Hortons secured a second round of financing led by Sequoia Capital China Fund, with increased investment from Tencent and participation from Zhongding Capital. This strong capital backing has filled Tim Hortons with confidence in the Chinese market. Tim Hortons plans to add 200 new stores in 2021 and open 1,500 coffee shops nationwide in the coming years.

Last November 16th, McDonald's also announced a major investment targeting the coffee market. McCafé, McDonald's coffee brand, officially announced that it will invest 2.5 billion yuan in the next three years to accelerate its layout in China's mainland coffee market. It is expected that by 2023, more than 4,000 McCafés nationwide will provide high-quality, cost-effective handmade coffee.

Of course, these are just two examples, and the number of brands receiving capital backing is far greater. We previously listed many new specialty coffee brand financing events in the coffee field in 2020, such as Yongpu, Sandunban, Shicui, etc. According to incomplete statistics, there were over ten coffee brand financing events in 2020.

Conclusion

In summary, the coffee industry still shows a growth trend. Now that 2021 is almost halfway over, the coffee market will usher in a new round of accelerated development in the coming period.

For more specialty coffee beans, please add FrontStreet Coffee on private WeChat, ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Coffee Varieties Overview What are the main coffee varieties?

Professional coffee knowledge exchange For more coffee bean information Please follow Coffee Workshop (WeChat public account cafe_style) In plant taxonomy, coffee belongs to the Rubiaceae family genus Coffeea, with at least one hundred coffee species beneath it. Approximately eighty coffee tree varieties have been confirmed, of which three are cultivated for beverage coffee: Arabica coffee species, Robusta coffee species

- Next

How to Adjust Pour-Over Parameters When Brewing Different Coffee Amounts with the Same Size V60 Dripper

For professional coffee knowledge and more coffee bean information, please follow Coffee Workshop (WeChat official account cafe_style). Introduction: The V60 #01 dripper is most suitable for brewing 1-2 servings of coffee, using 15-20g of coffee grounds. Some people find it difficult to drink this much when alone.

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee