Nestlé Announces! Bans Marketing High-Sugar Products to Children Under 16

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style).

For more premium coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex

As coffee consumption becomes increasingly daily, essential, and health-focused, with evolving consumer perceptions, consumers are placing more demands on their food and beverages. Coffee brands are continuously expanding their market share.

Nestlé's Global Marketing Ban for Children Under 16

Recently, global food giant Nestlé announced on its official website that to further strengthen its industry-leading responsible marketing practices, Nestlé will officially ban advertising of all its products to children under 16 worldwide starting July 1, 2023. This includes all confectionery, ice cream, and sugar-sweetened beverages.

This ban will apply to all television and online platforms, including social media and gaming platforms, where approximately 25% of the audience is under 16. Additionally, Nestlé will not collect data from minors and will only collaborate with social media influencers aged 18 and above.

Strategic Shift Toward Healthier Products

Looking at recent actions, Nestlé seems determined to shed its high-sugar label and undergo a "de-sugarization" transformation. In 2018, Nestlé sold its U.S. confectionery business and reintroduced more healthy products with low sugar, zero sugar, and zero calories, such as low-sugar beverages, unsweetened chocolate, and sugar-free coffee. Data shows that from 2016 to 2020, Nestlé has already reduced sugar content in its products globally by 5.1%.

From the industry market perspective, to align with the health trend in the food industry, Nestlé's decision to abandon high-sugar, high-calorie product categories and shift toward more natural and healthy products is highly beneficial for shaping its brand image. In the short term, stopping the marketing of high-sugar products to minors will inevitably impact Nestlé's confectionery business and sugary product performance growth. However, this move will undoubtedly bring greater benefits to Nestlé's long-term goals.

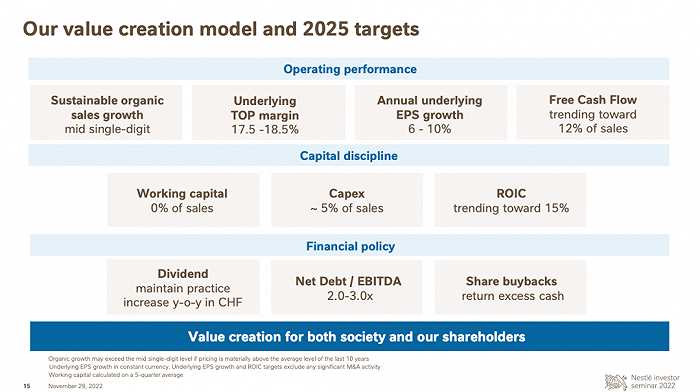

Financial Targets and 2025 Goals

Yesterday, Nestlé released its latest 2025 targets, stating that after profit margins were affected by sharply rising cost inflation in 2021 and 2022, it expects the basic operating profit margin to return to the 17.5% to 18.5% range by 2025.

Nestlé projects that between 2022 and 2025, the annual basic growth rate of earnings per share will reach 6% to 10% at constant exchange rates. Nestlé plans to achieve free cash flow equivalent to 12% of sales and realize a 15% return on invested capital by 2025.

Innovation in Low-Sugar Coffee Products

Previously, Nestlé launched a lightly sweetened black coffee called "Black Coffee," which not only features low sugar and zero fat but is also very suitable for multi-scenario consumption among today's young consumer groups. Of course, it's not just Nestlé—various companies and brands have continuously been entering and increasing their investment in low-sugar, low-calorie products in recent years. The coffee brand T97, established just last April, entered the market by featuring "low-calorie coffee."

In addition, Nongfu Spring, which crossed over from other sectors into the coffee track, has been continuously launching new low-calorie, low-sugar ready-to-drink coffee products, including black coffee, low-sugar latte, and sugar-free latte. They later launched a new premium pure black coffee series "Yirgacheffe," showing that competition is becoming increasingly fierce.

Brand Transformation for Younger Consumers

According to public information, Nestlé Coffee has 83 years of history since its establishment. With consumption upgrades, young consumers have become the main consumer group, and Nestlé is accelerating its brand transformation toward being more youthful, healthy, and premium.

In terms of marketing models, Nestlé has used pop-up stores to attract young people's attention. On the product level, Nestlé has successively launched new specialty fruit-extraction and premium drip coffee products. The continuous upgrading of ready-to-drink coffee continues to attract young consumer groups with low sugar, affordable prices, and innovative flavors.

Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Is Now the Right Time to Open a Coffee Shop? What You Need to Know About Opening a Coffee Shop During the Pandemic

For more professional coffee knowledge exchange and coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more specialty coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. The pandemic has changed many people's consumer expectations and also altered the way people interact with their lives.

- Next

Net Revenue of 306 Million! Tims China Reports Significant Growth in First Quarterly Report Since IPO

For more professional coffee knowledge exchanges and coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more premium coffee beans, please add FrontStreet Coffee on WeChat: qjcoffeex. Today, the renowned coffee chain brand Tim Hortons China announced its 2022

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee