Luckin Coffee Q3 Net Profit Exceeds 500 Million, Franchise Expansion Planned by Year-End

Luckin Coffee Reports Strong Q3 2022 Financial Performance

Professional coffee knowledge exchange - For more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more premium coffee beans, please add FrontStreet Coffee on WeChat (ID: qjcoffeex).

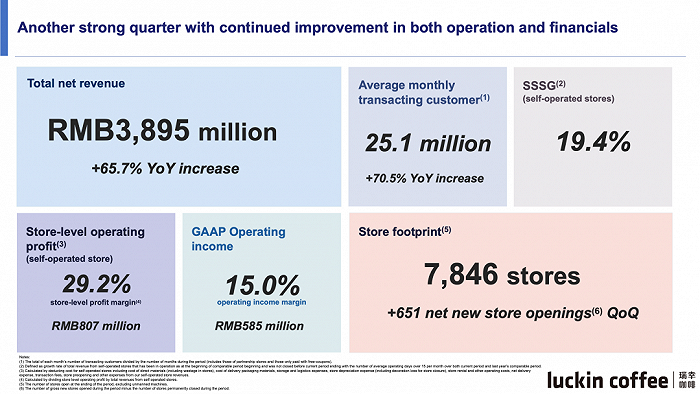

Yesterday, Luckin Coffee released its financial data for the third quarter of 2022, with total quarterly revenue increasing by 65.7% year-over-year to reach 3.895 billion RMB, and net profit of 529 million RMB. Under US Generally Accepted Accounting Principles (GAAP), operating profit was 585.3 million RMB, with an operating profit margin of 15.0%. The average monthly transaction customers reached 25.1 million, a 70.5% increase year-over-year, indicating an overall turnaround from losses to profitability.

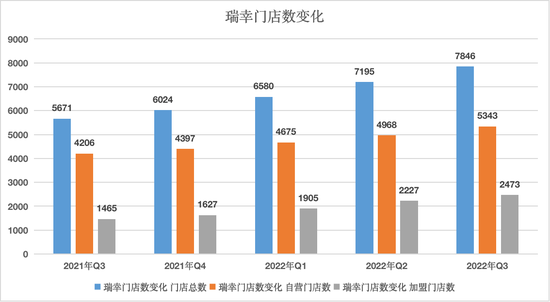

In terms of stores, Luckin Coffee opened 651 net new stores in the third quarter. As of the end of Q3, the company had a total of 7,846 stores, including 2,473 partnership stores and 5,373 self-operated stores. Compared to the same period last year, this represents an increase of 2,175 stores. In Q3 2021, Luckin Coffee had 5,671 stores, including 1,465 partnership stores and 4,206 self-operated stores. Today, its store count continues to maintain an industry-leading position.

In October 2017, the first Luckin Coffee store opened in Galaxy SOHO. Its headquarters, Luckin Coffee (China) Co., Ltd., was established in Xiamen in March 2018, with Guo Jinyi as the legal representative. The coffee chain has now developed into the coffee brand with the most stores in China, far surpassing Starbucks' thousands of stores.

Market Competition and Future Expansion

In the second quarter of this year, media outlets predicted that Luckin would likely surpass Starbucks China in revenue during the third quarter, securing the top position in China's coffee market. However, based on current data, Starbucks has temporarily maintained its first-place position. Starbucks China's Q3 performance showed some recovery, with net revenue of $696 million (4.968 billion RMB) - although still declining year-over-year, it increased by 29% quarter-over-quarter. Currently, Starbucks has 6,021 stores in China.

According to reports, in the third quarter, Luckin Coffee's total operating expenses were 3.3094 billion RMB, a 40.4% increase year-over-year. Among these, sales and marketing expenses were 159.3 million RMB, a 64.3% increase year-over-year, mainly due to Luckin Coffee's continued strategic investment in its brand through various channels, resulting in increased advertising expenses.

On August 22nd this year, Luckin Coffee announced that it has temporarily suspended partner recruitment, with the reopening time to be determined by official announcements. Meanwhile, Luckin Coffee has not developed any sub-brands, and information online about franchising or代理 Luckin Coffee and its sub-brands is all false.

However, during a conference call, Luckin's current Chairman and CEO Guo Jinyi expressed plans for franchise store expansion, stating that in December this year, Luckin Coffee will open a new round of partnership opportunities in lower-tier markets.

Strategic Market Positioning

In terms of store count, Luckin's number of self-operated stores in first and second-tier cities is gradually approaching its ceiling. Although this number has increased by nearly 1,000 stores over the past three quarters, the growth rate has slowed to around 7%. This may be why Luckin is reopening partnership opportunities in lower-tier markets.

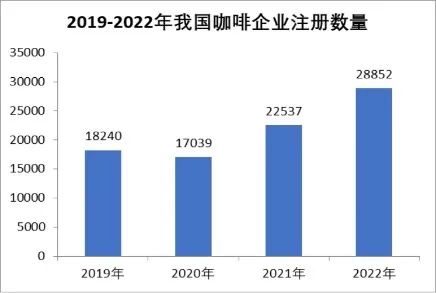

In the Chinese market, competition in the coffee sector remains fierce. The coffee track has attracted many entrepreneurs, with an increasing number of companies from various industries entering the market. Besides food and beverage companies, cross-industry players include China Railway, China Post, Huawei, NIO, and others, all contributing to the popularity of the coffee sector.

Recently, Canadian coffee chain Tims China partnered with e-commerce giant Alibaba Group to bring coffee products to millions of users on Alibaba's online marketplace. Tims China, which also received investment from tech giant Tencent Holdings, is rapidly expanding its business and expects to open 2,750 stores in China by 2026.

Future Growth Prospects

To date, Luckin's self-operated stores cover 60 cities, while franchise stores cover over 230 cities. With the reopening of franchise store opportunities, Luckin may be poised for another round of growth.

Image source: Internet

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Starbucks Coffee's Official Douyin Promotion for 0.01 Yuan Coupons? Later Refused Redemption Claiming It Was a Test

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more specialty coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. Starbucks has once again landed on the hot search list! This time it's due to the controversy triggered by their 1-cent marketing activity. Yesterday

- Next

Can Chinese-Style Coffee Capture the Palate of the Nation?

For more professional coffee knowledge and coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style). For more specialty coffee beans, please add FrontStreet Coffee's private WeChat account: qjcoffeex. New Chinese style has become a very hot topic in China's catering industry in recent years. With the development of the domestic market...

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee