Colombian Coffee Supply Shortage Drives Price Increases

Professional coffee knowledge exchange, more coffee bean information, please follow Coffee Workshop (WeChat public account: cafe_style)

Since the outbreak of COVID-19 at the end of 2019, the price trend of Colombian coffee has been unexpected.

In March 2020, international oil prices suddenly plummeted, and the Colombian peso depreciated nearly 25% against the US dollar. Since coffee beans are typically traded in US dollars on the international market, the coffee industry was able to benefit from exchange rate arbitrage. However, even though the Colombian peso has recovered somewhat against the US dollar, coffee prices have remained high over the past 14 months.

As Colombia implemented tax reforms that triggered massive protests, domestic transportation in Colombia was hindered, supply chains were severely disrupted, and prices soared again. Although the protests later paused, the FNC stated that it would take 3 to 4 months to fully resume coffee exports. In early May, the FNC broke the ceiling, offering coffee growers a high price of 1.44 million Colombian pesos ($386) per carga (about 275 pounds or 125 kilograms), a 34% increase from the beginning of the year.

However, prior to this, the Colombian coffee industry was already struggling with financial difficulties, with growers struggling to make a living, and some even giving up coffee cultivation altogether. This strengthened the Colombian government's determination to intervene in the market. In March 2020, a coffee price stabilization fund with a budget of 218 billion Colombian pesos (about $64 million) was launched to protect hundreds of thousands of coffee growers in Colombia from the impact of commodity market fluctuations.

However, due to continued record-high prices, the fund has not been affected since its establishment.

Internal Prices and Stabilization Fund

There are over 500,000 small coffee farms known as "fincas" in Colombia, which are widely dispersed across the geographic map. Most small coffee farms do not produce enough to directly supply private buyers, so they must seek help from intermediaries. For example, the Colombian National Federation of Coffee Growers (FNC), or local cooperatives.

Both the FNC and local cooperatives offer floating internal purchase prices to producers. Besides supply and demand, many factors can affect prices. These include: the exchange rate between the Colombian peso (COP) and the US dollar (USD), as well as futures contracts.

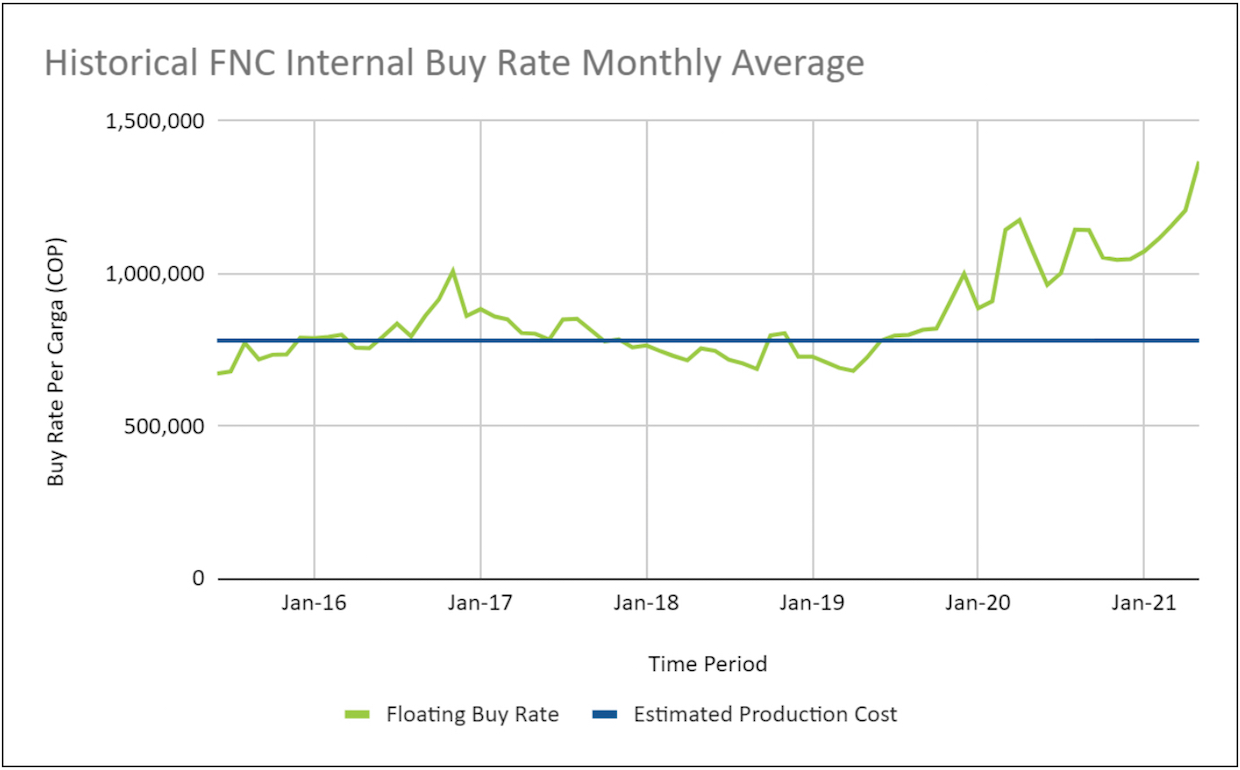

However, because selling prices were often lower than production costs, it was difficult for small coffee farms across Colombia to survive the last five years of the past decade.

The $64 million fund introduced by the Colombian government in March 2020 serves as a support when selling prices fall below costs, ensuring that growers can always sell their products at prices higher than their costs, allowing growers to focus more on improving coffee quality to attract the premium specialty coffee market.

An Unexpected 14 Months

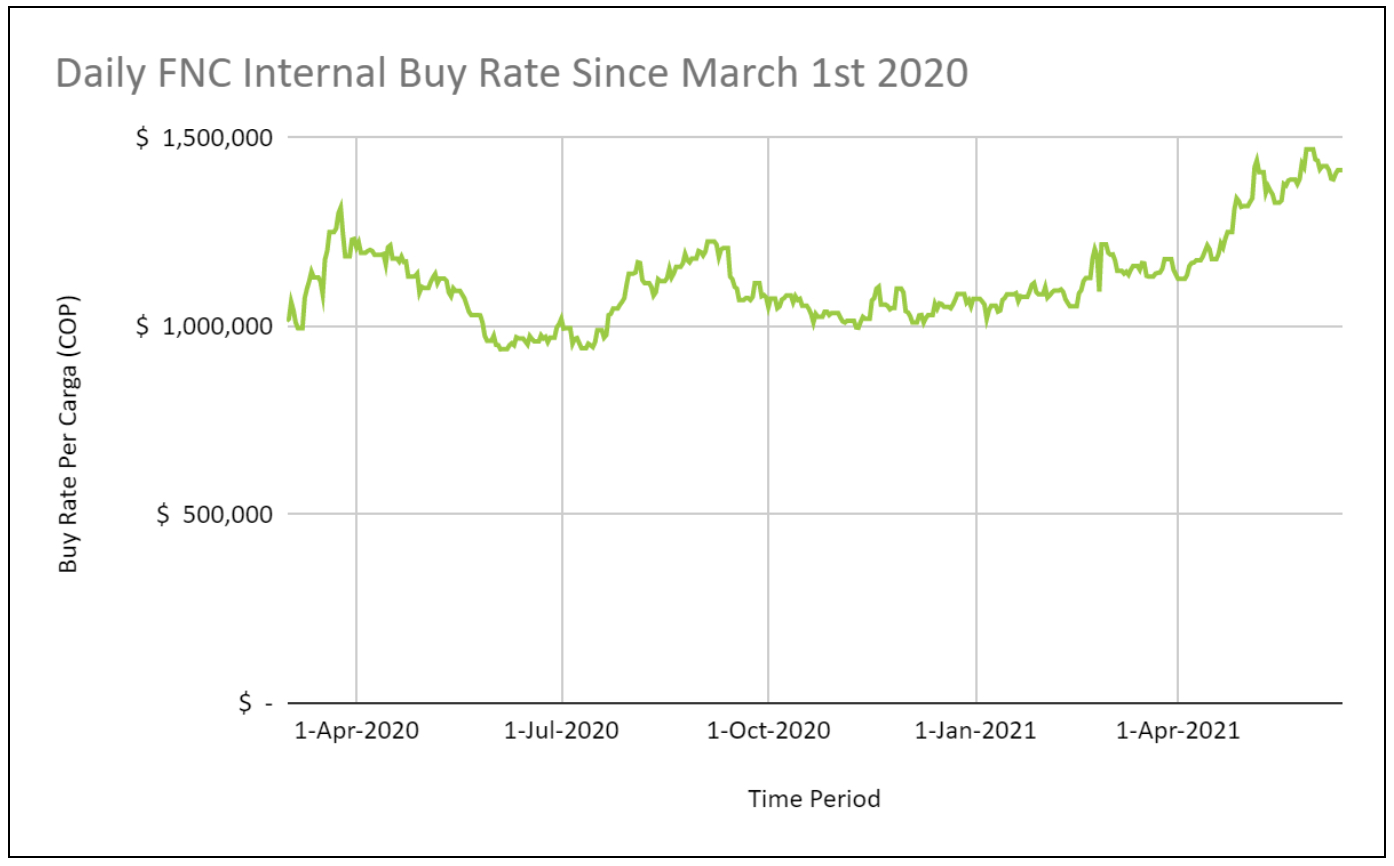

From mid-2019, internal purchase prices exceeded estimated production costs, and prices began to recover. However, during the early stages of the pandemic, prices began to soar. By the end of March 2020, Colombian coffee prices unexpectedly broke the 1 million Colombian peso ceiling, reaching 1.315 million Colombian pesos ($352), a 35% increase from early January 2020.

In addition to the depreciation of the Colombian peso against the US dollar, adverse climate conditions led to decreased coffee production in Brazil and reduced exports from Central America, causing supply tensions in the region and leading to the price surge in 2020.

Now, the FNC's internal purchase price has risen again. Since the beginning of this year, prices have increased by 34%, reaching a high price of 1.44 million pesos ($386) per carga (about 275 pounds or 125 kilograms).

Initially, prices rose due to the La Niña phenomenon, which began last September and was initially expected to last until mid-2021.

However, since the end of April this year, domestic turmoil in Colombia has pushed internal purchase prices to historical highs. Transportation disruptions in parts of Colombia have led suppliers to worry about fulfilling orders, resulting in decreased coffee supply and increased coffee prices.

Prospects

The situation in Colombia has not yet stabilized, and the destruction in Buenaventura is particularly severe. Buenaventura is one of the most important Pacific ports in the Americas, accounting for 60% of Colombia's maritime exports. Many highways remain blocked, meaning coffee exports are still restricted. The short to medium-term outlook remains unclear.

If the situation continues with transportation disruptions, it will coincide with the harvest season in June and July in some parts of Colombia, which could further drive up prices, even breaking the 1.5 million peso mark. Additionally, coffee prices have remained high since the beginning of last year, bringing unexpected windfalls to growers. There are concerns that if internal purchase prices remain high for an extended period, growers may become complacent.

Abnormally high prices may discourage growers from switching to higher-value crops, which is also a development goal set by the FNC.

Growers' incomes can still be harmed by many factors, and if the market experiences sudden price drops, they have little to rely on. Although the Colombian government's price stabilization fund provides a safety net, whether this mechanism will work remains to be tested.

According to data from Coffee Finance Network, as of the close on June 18, Colombian spot coffee was priced at 1.415 million pesos per 125 kilograms.

For more specialty coffee beans, please add FrontStreet Coffee on private WeChat, WeChat ID: kaixinguoguo0925

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Luckin Coffee Fraud Scandal Follow-up: Luckin Coffee Announces Completion of Financing Milestone with Bright Future Prospects

For professional coffee knowledge exchange and more coffee bean information, please follow Coffee Workshop (WeChat official account: cafe_style). According to Zhitong Finance APP, on June 15th, Luckin Coffee (OTC: LKNCY) announced that it has completed a financing milestone based on the restructuring support agreement (RSA) signed with holders of the company's $460 million convertible preferred bonds due in 2025.

- Next

Types of Coffee Drippers and Their Characteristics: How to Choose the Right One for You

As a coffee beginner starting to explore pour-over coffee, you'll discover that pour-over kettles, drippers, and filter papers are essential components. While you can use alternative containers if you don't have a serving pot, without a dripper, it's like trying to cook without rice—unable to filter coffee grounds, meaning you can't enjoy the coffee. Pour-over coffee, with the arrival of the third wave of coffee culture, is gaining popularity among more and more coffee enthusiasts.

Related

- How to make bubble ice American so that it will not spill over? Share 5 tips for making bubbly coffee! How to make cold extract sparkling coffee? Do I have to add espresso to bubbly coffee?

- Can a mocha pot make lattes? How to mix the ratio of milk and coffee in a mocha pot? How to make Australian white coffee in a mocha pot? How to make mocha pot milk coffee the strongest?

- How long is the best time to brew hand-brewed coffee? What should I do after 2 minutes of making coffee by hand and not filtering it? How long is it normal to brew coffee by hand?

- 30 years ago, public toilets were renovated into coffee shops?! Multiple responses: The store will not open

- Well-known tea brands have been exposed to the closure of many stores?!

- Cold Brew, Iced Drip, Iced Americano, Iced Japanese Coffee: Do You Really Understand the Difference?

- Differences Between Cold Drip and Cold Brew Coffee: Cold Drip vs Americano, and Iced Coffee Varieties Introduction

- Cold Brew Coffee Preparation Methods, Extraction Ratios, Flavor Characteristics, and Coffee Bean Recommendations

- The Unique Characteristics of Cold Brew Coffee Flavor Is Cold Brew Better Than Hot Coffee What Are the Differences

- The Difference Between Cold Drip and Cold Brew Coffee Is Cold Drip True Black Coffee